Palantir Technologies: A Surge in AI-Driven Growth and Strategic Partnerships

Introduction

Palantir Technologies Inc. (NASDAQ: PLTR), a leading provider of data analytics and artificial intelligence (AI) software, has been making important progress toward 2025. With its stock price soaring to new heights and a series of high-profile contracts and partnerships, Palantir is cementing its position as a key player in both government and commercial sectors. This article explores the latest updates on Palantir, including its financial performance, strategic initiatives, and market sentiment, highlighting why the company continues to capture investor attention.

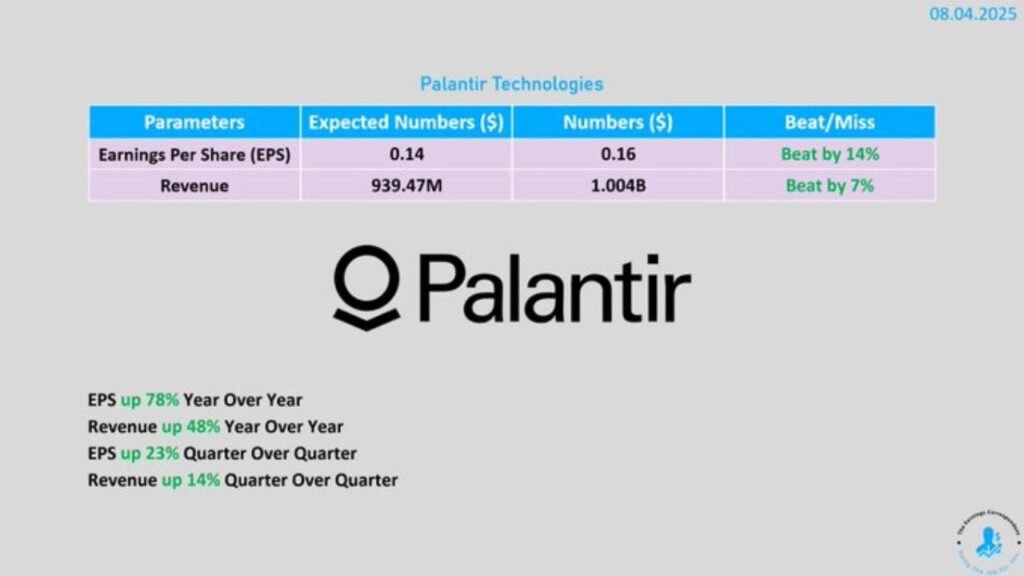

Financial Performance: A Billion-Dollar Milestone

Palantir reported a landmark achievement in its Q2 2025 earnings, marking its first billion-dollar revenue quarter. The company posted revenue of $1.004 billion, a 48% year-over-year increase, surpassing analyst expectations of $939.25 million. Earnings per share (EPS) came in at $0.16, beating consensus estimates of $0.14 and reflecting a 77% increase from the previous year. Strong growth in both its U.S. commercial and government segments drove this robust performance. U.S. commercial revenue reached $306 million, up 93% year-over-year, while U.S. government revenue grew to $426 million, a 53% increase.

The company also raised its full-year guidance, signaling confidence in sustained growth. CEO Alex Karp attributed this success to Palantir’s integration of AI technology, stating, “The growth rate of our business has accelerated radically. Yet we see no reason to pause, or relent, here.” This milestone underscores Palantir’s ability to capitalize on the growing demand for AI-driven data analytics solutions.

Major Contracts and Strategic Partnerships

Palantir has secured several high-value contracts and partnerships in 2025, reinforcing its dominance in defense and enterprise analytics:

- U.S. Army Contract: Palantir landed a monumental contract with the U.S. Army, potentially worth up to $10 billion over a decade. This deal consolidates multiple contracts into a single enterprise agreement, focusing on the integration of AI into geospatial intelligence and other critical defense applications. Wedbush analyst Dan Ives described it as “one of the largest ever DOD software contracts in U.S. history,” highlighting its significance for Palantir’s federal business.

- Nuclear Operating System (NOS): Palantir partnered with The Nuclear Company to develop the Nuclear Operating System, an AI-driven platform built on Palantir’s Foundry. The NOS aims to transform nuclear reactor construction by optimizing schedules, reducing costs, preventing issues through digital twin technology, and enhancing regulatory compliance. This partnership aligns with U.S. executive orders targeting 400 GW of nuclear capacity by 2050.

- Warp Speed for Warships: In collaboration with BlueForge Alliance, Palantir launched the Warp Speed for Warships program, funded by the U.S. Navy’s Maritime Industrial Base Program. This initiative leverages Palantir’s Foundry platform to streamline warship production and enhance fleet readiness through real-time collaboration and data integration.

- Commercial Partnerships: Palantir announced a multi-year partnership with Fedrigoni, a global manufacturer of specialty papers and labels, to accelerate digital transformation using AI. This collaboration, supported by Avatar Investments, aims to enhance operational efficiency and market responsiveness. Additionally, Palantir partnered with Accenture Federal Services to deploy AI-powered solutions for U.S. clients and with Deloitte to create an Enterprise Operating System combining Deloitte’s expertise with Palantir’s Foundry and AIP platforms.

- NATO and ICE Contracts: Palantir secured a historic deal with NATO and a $30 million contract with U.S. Immigration and Customs Enforcement (ICE), further expanding its influence in government and defense sectors. These contracts have helped Palantir outperform the broader tech market, with its stock gaining nearly 10% in April 2025 despite a Nasdaq 100 decline of over 4%.

Stock Performance and Market Sentiment

Palantir’s stock has experienced remarkable growth, climbing over 400% in the past year and reaching an all-time high of $156.0 in July 2025. As of August 4, 2025, the stock traded at $160.35, with a market capitalization of $364.06 billion. The stock surged 4% in after-hours trading following the Q2 earnings report and gained 3.6% after Piper Sandler initiated coverage with an “Overweight” rating and a $170 price target, citing Palantir’s unique growth and margin model.

However, analysts remain divided. While Wedbush’s Dan Ives raised his price target to $160, maintaining a bullish outlook, others express concerns about Palantir’s high valuation, with a forward price-to-sales ratio of 86.7x, significantly above the sector average. The consensus analyst rating is a cautious “Hold,” reflecting a balance between growth prospects and valuation risks. Posts on X reflect mixed sentiment, with some users celebrating the stock’s new highs and others warning of potential risks, such as the Department of Defense testing AI models from Microsoft and OpenAI to reduce reliance on vendors like Palantir.

Technological Innovations

Palantir’s core platforms—Gotham, Foundry, Apollo, and the Artificial Intelligence Platform (AIP)—continue to drive its success. Gotham helps find patterns in complicated data, Foundry builds systems to manage data in one place, Apollo makes sure software is delivered smoothly, and AIP uses large language models (LLMs) to turn both organized and unorganized data into useful information. These platforms have positioned Palantir as a leader in practical AI solutions, avoiding “shelfware” and focusing on real-world applications.

Challenges and Risks

Despite its achievements, Palantir faces challenges. Its high valuation and significant share-based compensation have raised concerns among analysts. International commercial revenue faces headwinds, and the company’s reliance on U.S. government contracts poses potential risks. Additionally, reports suggest the Department of Defense is exploring alternatives to reduce dependence on Palantir, which could impact future growth.

Conclusion

Palantir Technologies is at a pivotal moment, leveraging its AI-driven platforms to secure transformative contracts and partnerships while achieving unprecedented financial milestones. The company’s ability to integrate AI into defense, nuclear, and commercial applications has fueled its stock’s meteoric rise and garnered significant investor interest. However, valuation concerns and competitive pressures warrant caution. As Palantir continues to innovate and expand, it remains a high-risk, high-reward investment in the rapidly evolving AI landscape.

Post Comment