A New Chapter In Monetary Policy: Understanding The Fed’s Largest Rate Cut In Years

- Leave a Comment

- James M

- September 19, 2024

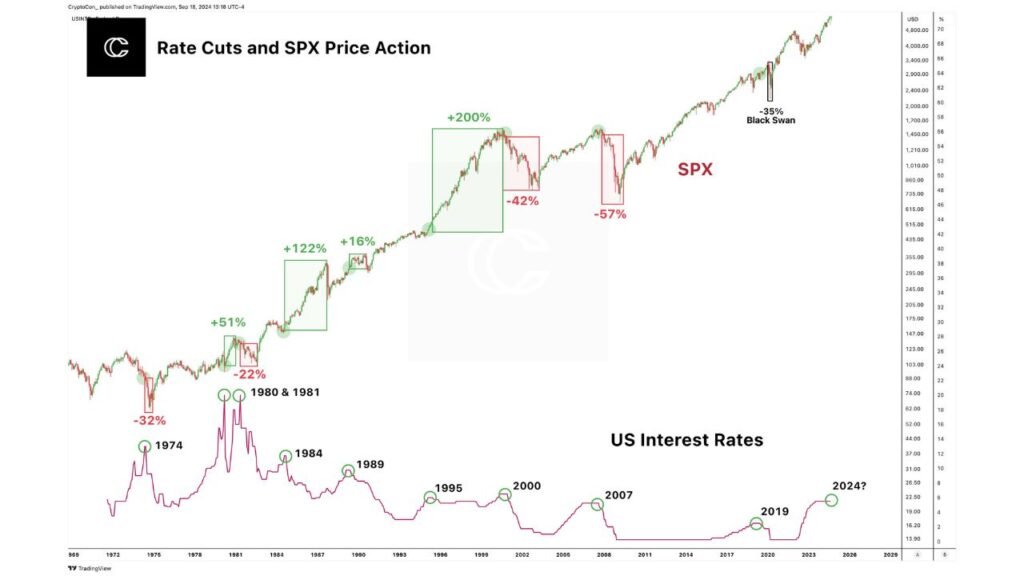

The Federal Reserve recently made headlines when it reduced interest rates by half a percent, which was the first time since the early stages of the COVID-19 pandemic.

The purpose of this sudden action, which reduced the federal funds rate to a range of 4.75% to 5%, was to proactively address indications of an impending economic slowdown, especially in the labor market.

The Fed’s swift responsiveness to changing economic conditions is demonstrated by this significant reduction, which also raises concerns about softening job numbers and inflation that is still above target.

This rate drop is noteworthy due to its magnitude as well as the fact that it is the first big easing program in the last four years. Aside from emergency steps during the epidemic, the last time the Fed reduced rates so sharply was during the 2008 global financial crisis.

The Federal Open Market Committee (FOMC) of the central bank determined that a decisive action was required to assist the economy and preserve price stability since unemployment was beginning to rise and inflation was beginning to moderate.

This decision highlights the Fed’s proactive approach to averting possible economic difficulties, even in the face of relatively constant GDP growth and consumer expenditure.

This post aims to explore the reasoning behind the Fed’s decision, the financial markets’ initial responses, and the wider ramifications for the US and worldwide economies.

We seek to offer a thorough analysis of the implications of this daring action for the future of the economy by looking at the elements that shaped the Fed’s approach and how this cut might impact everything from mortgage rates to global monetary policy.

Context & Background

There were conflicting signs in the economic environment before to the Fed’s announcement. One the one hand, there were indicators of a slowdown in the labor market, which is a crucial gauge of the state of the economy.

The post-pandemic job recovery phase saw a significant slowdown in job gains, and the unemployment rate increased slightly to 4.2%. This upward trend, while still low by historical standards, sparked questions about how long employment growth would last.

A precarious situation resulted from inflation continuing to exceed the Fed’s 2% target, while not being as bad as it was at its peak in 2022. In order to stimulate economic development without escalating inflationary pressures, the Fed needed to strike a balance.

This rate drop, which is significant—50 basis points—has not been seen outside of emergency situations in more than ten years. Aside from emergency measures taken during the COVID-19 epidemic, the last time the Fed made such a significant reduction was during the 2008 financial crisis.

The Federal Reserve cut interest rates sharply back then in an effort to combat a severe credit crunch and a collapsing economy.

Even though the state of the economy is not as bad as it once was, a strong response was nevertheless necessary given the current state of the labor market’s cooling and the ongoing inflation.

The analogy emphasizes how serious the Fed is about these issues and how prepared it is to act now to prevent a possible slump.

The Fed’s deliberate shift toward more aggressive easing is indicative of its determination to maintain economic stability during a time of increased unpredictability. The promotion of maximum employment and preservation of price stability are the two mandates of the central bank.

The Fed realized it needed to take significant action to assist the economy as employment growth was slowing and inflation was decreasing but still above target.

Its decision to lower rates by half a percent represents a break from its more circumspect stance of previous years, when it favored more gradual rate adjustments.

This audacious move highlights the central bank’s proactive approach to modifying monetary policy to conform to changing economic circumstances.

This rate cut’s size and timing have historical importance. The Fed is making it apparent that it intends to anticipate any economic challenges by making such a significant cut at a time when the majority of economic indices, such as GDP and consumer spending, are still comparatively high.

This action implies that the central bank is anticipating difficulties that might not yet be completely evident in conventional economic measures, rather than just responding to the state of affairs as it is.

It represents the Fed’s deliberate move toward more proactive and dynamic policymaking with the goal of guiding the economy through a challenging and unpredictable environment.

"The U.S. economy is in a good place and our decision today is designed to keep it there."

— CBS News (@CBSNews) September 18, 2024

Federal Reserve Chair Jerome Powell says the Fed's move to cut interest rates by 0.50 percentage points will help push the country's economy in a positive direction. He added that while… pic.twitter.com/oaLGmuPgmn

Justification for the Choice

The job market was a major factor in the Federal Reserve’s decision to lower rates by 0.5 percentage points. Although relatively low by historical standards, recent data revealed an uptick in the unemployment rate to 4.2%, which marked a substantial departure from the almost record lows observed in prior months.

Together with slower job growth, this increase in unemployment raised the possibility of a cooling labor market, which could impede overall economic growth.

Consumer confidence and spending, which are important economic drivers, could decline as fewer jobs are added each month. In this case, the Fed would need to intervene and support the economy by lowering borrowing costs.

The labor market was not the only thing the Fed was keeping a careful eye on: the dynamics of inflation. Even while core inflation has dropped from its previous peaks to 2.6%, it is still marginally above than the central bank’s 2% target.

Though the Fed is wary of a premature celebration of success, the decline in inflationary pressures is encouraging.

Premature relaxation of oversight could lead to inflationary pressures, especially if labor market wage growth resumes. The Fed wants to stabilize inflation without resorting to extreme measures that would lead to a recession or large-scale job losses.

Effectively controlling inflation while preventing a rapid rise in unemployment is the Fed’s problem; this delicate balancing act is sometimes referred to as attaining a “soft landing.” Reducing interest rates just enough to boost the economy without sending it into overdrive is a crucial component of this plan.

The Fed believes that quick action is necessary given the current state of the economy, which is why it decided to make a relatively significant cut.

The Federal Reserve (Fed) intends to lower borrowing costs in order to stimulate consumer spending and business investment, which should help economic development and job creation without allowing inflation to get out of control.

Fed Chair Jerome Powell emphasized this delicate balancing act in his statements following the decision. He remarked, “We’re trying to achieve a situation where we restore price stability without the kind of painful increase in unemployment that has come sometimes with this inflation.”

This statement highlights the Fed’s commitment to achieving both stable prices and maximum employment. However, the decision was not unanimous. Governor Michelle Bowman dissented, preferring a more cautious approach with a smaller, quarter-point cut.

This dissension, which is the first from a Fed governor since 2005, highlights the disparities in opinions among members of the FOMC over the appropriate level of aggressiveness in the central bank’s rate-cutting program.

These differences in opinion highlight how complicated the present economic environment is and how difficult it is for the Fed to decide on policies that strike a balance between various economic risks.

Reporter: The FED cut the interest rates by a half percentage point today— going to alleviate inflation for a lot of people.

— Acyn (@Acyn) September 18, 2024

Crowd: Boo!!! pic.twitter.com/CODM14qjeS

The market was initially volatile in response to the Fed’s half-point rate drop, which was understandable given the surprise and unpredictability of such a significant decision.

The Dow Jones Industrial Average rose by as much as 375 points shortly after the news, showing a favorable reaction from investors who first viewed the cut as a clear indication of the Fed’s commitment to bolstering the economy.

But when the news spread and investors started to consider the ramifications, the rise stalled, and markets closed the day marginally lower.

This erratic behavior highlighted the conflicting emotions on Wall Street, which were worries about the implications of the rate decrease for the underlying health of the economy and optimism about the Fed’s assistance.

Treasury rates responded sharply as well, rising after the rate reduction. The increase in rates indicated that investors were adjusting their projections for inflation and future economic development.

Bond prices rise in reaction to reduced interest rates, but the spike suggested a more nuanced picture. It can be a reflection of market apprehension over the Fed’s upcoming actions and the likelihood of additional rate reduction.

Future yields may decrease if the market believes that the economy is weakening more than anticipated and increases demand for safe-haven assets like Treasurys. Therefore, the present yield hike may only be a transitory response as investors consider the full ramifications of the Fed’s approach.

Analysts and economists have differing opinions on the Fed’s drastic rate cut. The market had anticipated that this drop would be the start of a run of 50 basis point reductions, but Fed Chair Jerome Powell’s remarks seemed to moderate those expectations, according to Tom Porcelli, chief U.S. economist at PGIM Fixed Income.

Porcelli called Powell’s emphasis on the Fed’s lack of precommitment to a series of significant cuts the “right call,” implying that the Fed is keeping its options open in reaction to new information.

With this cautious statement, the Fed hopes to reassure the markets that, although it is ready to act decisively, it is not committed to any one course and has flexibility in its policy choices.

Investor anxiety is still high as markets assess the effects of this rate reduction. Some perceive it as a proactive measure to maintain growth and avert a recession, while others read it as an indication that the Fed anticipates more significant economic difficulties.

The initial spike and subsequent decline in stock prices are proof that this uncertainty has enhanced market volatility. The differing responses are a reflection of a larger lack of confidence in the direction that the economy and the Fed will take going forward.

Market players will probably continue to exercise caution as the central bank negotiates these unfamiliar seas, attentively examining each economic data and Fed announcement for hints about what might happen next.

According to the Fed’s most recent dot plot estimates, which show the expected trajectory of interest rates based on the forecasts of individual members, further rate reduction are likely for 2024 and beyond.

In line with market expectations, the central bank hinted at the possibility of another 50 basis points of reduction before the end of the year.

The federal funds rate could decrease significantly from its current levels if the dot plot indicates that it will by another full percentage point by the end of 2025 and another half-point in 2026.

The Fed expects that economic conditions will justify further easing to support growth and control inflation, as these projections demonstrate. However, the precise timing and magnitude of future cuts will depend on how the economy develops.

On the future course of rates, there is a noticeable difference in opinion among members of the Federal Open Market Committee (FOMC).

While some authorities worry that lowering too soon will increase inflationary pressures, others think that if GDP and employment continue to deteriorate, the economy may need more drastic cuts.

Governor Michelle Bowman dissented in support of a lesser, quarter-point cut, which was reflected in the 11-1 vote for the most recent cut.

These divergent opinions reflect that the FOMC is not in agreement about the best way to handle the complicated economic environment, which implies that future policy choices may be controversial and reliant on the most recent economic data.

In the future, the Fed will have a difficult time striking a balance between managing inflation and economic growth. On the one hand, additional rate cuts might be required to boost demand and avert a more severe slowdown if the labor market continues to deteriorate and inflation stays low.

However, if inflation turns out to be more persistent than expected, lowering rates too quickly runs the risk of reviving price pressures, damaging the Fed’s reputation, and necessitating a change in policy down the road.

In this delicate context, the central bank’s ability to adjust monetary policy will be essential to preventing both a harsh landing and runaway inflation.

There are considerable dangers associated with either keeping the existing rates or making more reduction. If the Fed keeps cutting rates sharply, it runs the risk of exhausting its toolkit of policy options before the economy reaches a tipping point, which would leave it with fewer options in the event of a more serious recession.

On the other hand, the Fed may come under fire for responding too slowly and possibly accelerating a recession if it chooses to keep rates unchanged and the economy deteriorates more quickly than anticipated.

Another degree of complication is added by the global economic climate and the fact that other central banks have also adjusted their policies in response to the Fed’s moves.

As the Fed works to guide the economy through these difficult times, it must exercise caution to prevent unexpected repercussions on a national and international level.

The recent rate drop by the Federal Reserve is expected to have a big impact on other central banks worldwide. Reevaluating their own monetary policy positions is likely for the Bank of England and the European Central Bank (ECB) in light of the Fed’s indications of a shift in easing monetary policy.

Because of the interdependence of the world’s economy, changes in the Federal Reserve’s interest rate have a domino effect on other central banks, especially those that are dealing with comparable economic challenges.

If the Fed keeps relaxing, other institutions might be inspired to do the same, starting a worldwide trend toward lower interest rates meant to spur growth in the face of faltering economies.

Global central banks may consider easing, which might have significant effects on global markets. A weaker US currency may result from lower interest rates, increasing export competitiveness and possibly raising commodities prices.

As a result of this dynamic, capital flows into emerging countries may occur as investors look for greater returns in areas with lower borrowing costs.

It also prompts worries about inflationary pressures in these areas, since a capital inflow could increase demand and asset values.

As policymakers negotiate the consequences from the Fed’s decision, they will be focusing on how to maintain a careful balance between regulating inflation and promoting growth.

Global liquidity is further complicated by the Fed’s continuous balance sheet reduction through a process known as quantitative tightening (QT), which occurs in conjunction to interest rate reductions.

The Fed essentially lowers the amount of money in circulation in the economy by allowing aging Treasuries and mortgage-backed securities to roll off its balance sheet at a rate of up to $50 billion per month.

Although the goal of this process is to return monetary policy to normal after years of extraordinary measures, it may also tighten liquidity conditions globally as well as in the United States.

Decisions about monetary policy may become more complex for central banks in other nations if they are forced to take into account their own liquidity measures in response to possible Fed tightening.

It is impossible to overestimate how quantitative tightening has affected global liquidity. Longer term increases in interest rates could result from a decline in the Fed’s balance sheet since less capital will be available.

This may make things difficult for individuals and companies who depend on credit, which could slow down the economy.

Furthermore, financial markets may become more volatile as liquidity becomes scarcer, especially in emerging nations that are more susceptible to changes in global capital flows.

In the coming months and years, not just the direction of the U.S. economy but also the wider ramifications for the stability of the world economy will depend greatly on how carefully the Fed manages rate reduction and quantitative tightening.

We would like to hear your opinions on this crucial move as we work through the effects of the Fed’s recent half-point rate drop. What are your predictions for the short- and long-term effects of this decision on the economy?

Do you think there are any possible hazards associated with the Fed’s policy, or do you think it is a sound one? We can all gain a better understanding of the intricacies of monetary policy and how it affects our day-to-day existence by having this conversation.

We have put up a list of helpful resources for individuals who want to learn more about monetary policy and economic trends.

More background on the Fed’s decision-making process, historical comparisons, and professional assessments of the state of the economy can be found in articles from respectable financial news sources and economic research organizations.

You can learn more about the elements that influence central banks’ decisions and how they operate by looking through these resources.

I'd suggest reading the following books:

- The thorough manual “Understanding the Federal Reserve: How Monetary Policy Works” explains the workings of the Fed’s monetary policy.

- “The Impact of Interest Rate Cuts on the Economy” examines how different economic sectors are impacted by interest rate changes.

- “Global Central Banks and Monetary Policy Trends” provides a summary of the ways in which various central banks are adapting to comparable economic challenges.

As you continue to delve into the fascinating realm of economic policy, we hope that these resources will prove to be beneficial. Your participation and inquisitiveness are essential to building an informed community!

Conclusion:

In order to address growing concerns about the job market and control inflation, the Federal Reserve recently made a substantial and calculated decision to decrease interest rates by half a point.

The Fed’s justification for this bold move rests on the labor market’s slowing down, which is demonstrated by the unemployment rate rising to 4.2% and the core inflation rate gradually falling to 2.6%.

These elements forced the central bank to move decisively in order to boost economic expansion while juggling inflation management in a precarious way.

The stock market’s initial volatility and rising Treasury yields, which represented investors’ conflicted feelings about the Fed’s plan, were indicative of both investor optimism and concern.

The decision made by the Fed has important ramifications for the U.S. economy and the global financial system going forward. The Fed is putting itself in a position to react quickly to changing economic conditions, with predictions pointing to additional rate reductions in the upcoming years.

The FOMC’s disagreements, however, show how difficult it is to manage monetary policy in a volatile climate where the risks of inflation and recession are significant.

The constant struggle will be to boost GDP without sparking inflation again, especially since other central banks might decide to loosen monetary policy in response to the Fed’s example.

Although the Fed’s daring decision to lower interest rates may be seen as a necessary response to the present economic difficulties, it also creates a degree of uncertainty that will need close observation.

How well the Fed handles this shift and reacts to new information will determine the long-term effects on the US and world economies.

The decisions made by policymakers as they work through these problems will probably have a long-term impact on the economy, affecting everything from investment plans to consumer purchasing. The entire globe will be intently observing how this crucial juncture plays out in the larger story of the economy.